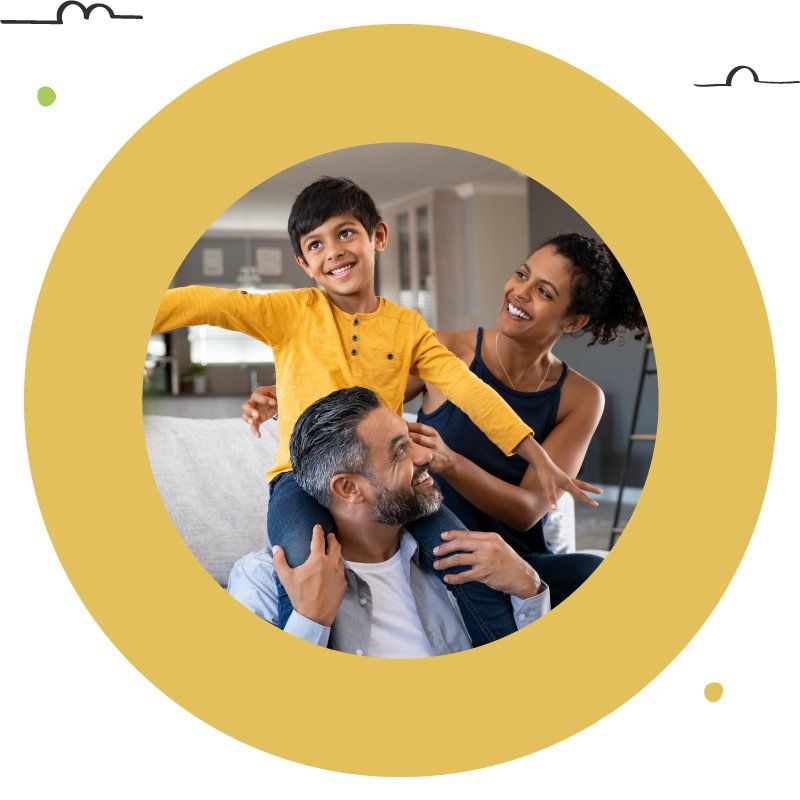

Don’t hope for balance, create it.

A team of friendly accountants in Leicester helping you get off the hamster wheel so you can run a successful business without missing out on the important things in life.

Who we help

As a leading accounting firm in Leicester, we are here to support family-oriented business owners, wanting to make enough to support their families and live the life they want. We specialise in helping limited companies or sole traders looking to become limited companies, our Leicester-based accountancy firm welcomes anyone looking to secure their financial future.

The complexities of accounting and financial planning

You’re carrying the weight of the world on your shoulders and working really hard to provide for everyone, and feel like life is passing you by. The never-ending pull between priorities is exhausting and can be a fast track to burnout.

It often takes a big shake-up in life to force us to make a change. We aim to help our clients avoid the wake-up call by spending time on what’s most important for them now.

We are Chartered Accountants and Tax Advisers in Leicester, trust us to guide you to achieving your dreams.

Our values

Our values are at the heart of everything we do. They're not just words on a page—they're what make us tick.

They form the foundation of our culture and drive our daily actions – from the way we act, the decisions we make and how we work with and treat others.

Be present

Change lives

Own it

Ambitiously dedicated

Be memorable

“My mission is to help young families like mine to run successful businesses without compromising their families and their lives”

Shafiq H. Khan FCA CTA, Director of Bloom Accounting

Free up your time - we'll handle your accounting

We believe a business should be the vehicle that gives you what you want from life, rather than taking precious time away from you. We look at your life motivations and get clear on what your business needs to be doing for you.

Start by offloading the bookkeeping and accounting tasks to our skilled accountants in Leicesterso you can plan for the balance you want.

Our bookkeeping services in Leicester are tailored to free up your time, allowing you to focus on what matters most.

Shafiq at Bloom Accounting has been doing my accounts and book keeping for almost five years, and has just recently started to organise our pay roll. All of this at a very reasonable cost.

They are very professional and really easy to get hold of, which makes running my business much easier when I need some advice. I would definitely recommend Bloom to others as the level of service and attention to detail is of the highest standard.

Dean Kassie

Director, DK Electrical

Latest blog articles

Start now

Take the first steps. Tell us what balance looks like to you so we can start freeing up your time.